Many exchanges are simply trying to steal your credit card information! The difference is that online money is fiat money denoted by online codes such as numbers, etc. Many merchants are accepting Bitcoin. The wallet applies the same principle as the mobile wallet.

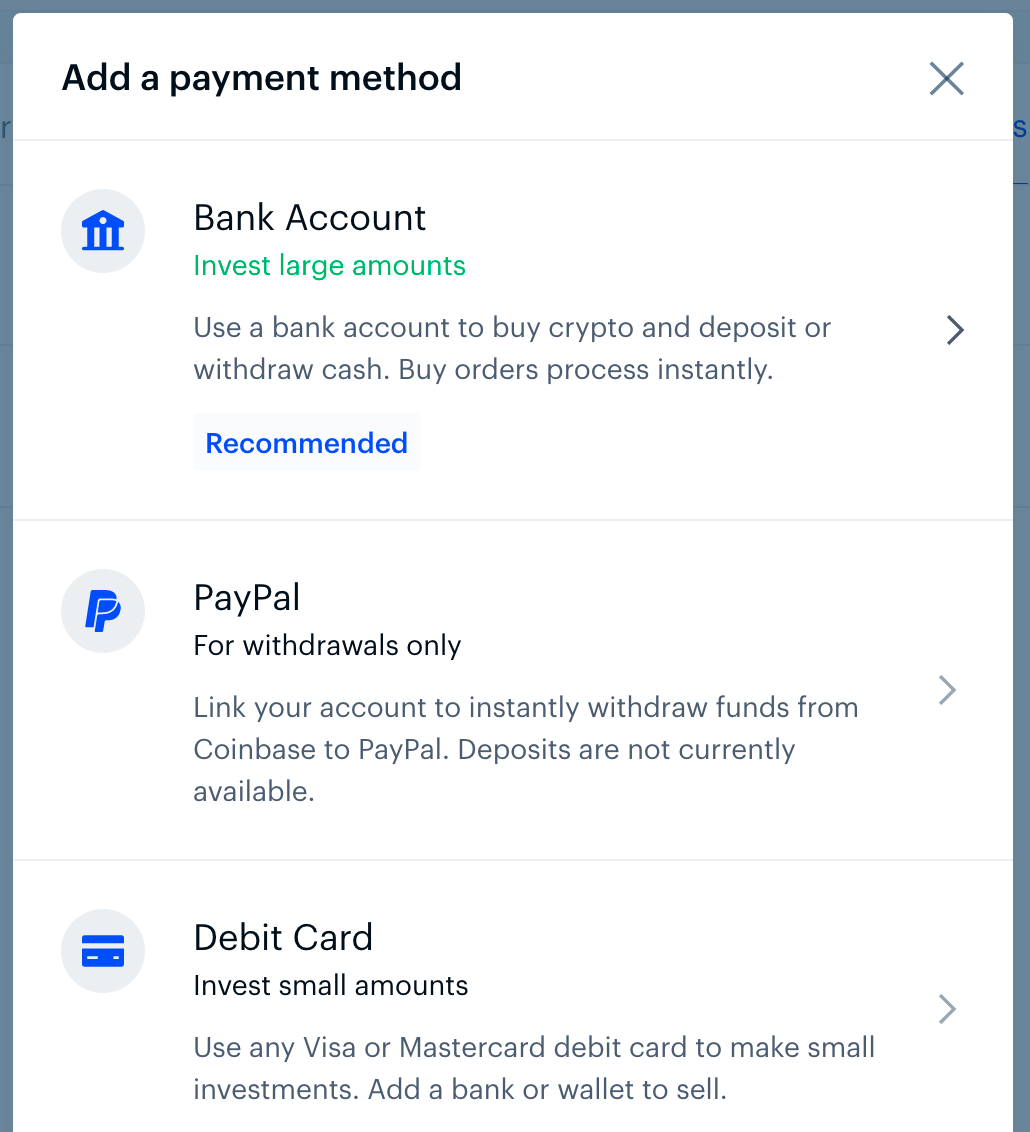

Depending on how you go about it, buying Bitcoin on credit can be just as safe as any other method, but it can also be downright dangerous. Buying Bitcoin with your credit card is just as simple as buying with a debit card or paying directly from your bank account, though it does come with a few extra restrictions. Coinbase, which is arguably the most popular digital currency exchange around, will happily take your credit card. Coinbase also charges a 3. If you want to use your Amex you can try Coinmamaanother popular ameriac that charges a slightly higher 5 percent fee on transactions. When it comes to credit cards, Visa and Mastercard both allow cryptocurrency purchases—at least for .

Introduction to Buying

He would settle in Missouri, farming on the Missouri River, until he contracted malaria. That would prompt a move even farther west, to Oregon, where the air was better. His stay in Oregon would be brief, as he moved south to work at Sutter’s Fort in California. I love reading about the Gold Rush because it’s a common story that repeats itself. There’s a discovery of riches and then people flock to it.

Credit/Debit Card Bitcoin Exchanges

Depending on how you go about it, buying Bitcoin on credit can be just as safe as any other method, but it can also be downright dangerous. Buying Bitcoin with your credit card is just as simple as buying with a debit card or paying directly from your bank account, though it does come with a few extra restrictions. Coinbase, which is arguably the most popular digital currency exchange around, will happily take your credit why bank of america wont let me buy bitcoin.

Coinbase also charges a 3. If you want to use your Amex you can try Coinmamaanother popular exchange that charges a slightly higher 5 percent fee on transactions. When it comes to credit cards, Visa and Mastercard both allow cryptocurrency purchases—at least for. Chase also allows you to buy Bitcoin, though finding an exchange that takes that card might be difficult. Discover is the only credit card company that has outright banned cryptocurrency purchases, making the decision all the way back in As for the major banks, Capital One blocked its customers from buying Bitcoin with their credit cards earlier this month.

JP Morgan Chase also allows Bitcoin credit card purchases, while TD Bank explained that some sales may get rejected because of security measures already in place.

Buying Bitcoin still feels a lot like gambling. The market is so volatile. The risks and potential rewards are so big. According to a survey released last month via the WSJ18 percent of Bitcoin buyers used a credit card. The A. Jacob Kleinman. Filed to: No one actually understands Bitcoin. Share This Story. Get our newsletter Subscribe. The Best Bitcoin and Ethereum Explainers.

Bank Of America And PayPal Told Me To Buy Bitcoin!

Cash Back As reported yesterday, British banking group Lloyds has also reportedly blocked card holders from several of its major subsidiaries — including Halifax, MBNA and Bank of Scotland — from purchasing bitcoin on credit. Vice-versa, most Bitcoin brokers also let you specify the amount of bitcoin you want and will charge you the equivalent in fiat. Buyy on the exchange. Coinmama, on the other hand, supports Bitcoin, litecoin, ether and cardano. That’s it! The options for buying the leading cryptocurrency are diverse:. The reasons for the bans are as follows:. The features of Bitcoin are:. Note that the fees are not displayed publically but displayed in your buy price when completing your purchase. So any exchange selling bitcoins for CC payments is always going to pass this fee off to you, plus charge a bit more to make a profit. One you enter your card information press «Bezahlen»:. The FAQ section below should answer all leh your remaining questions. He cites the transaction fees — which often hover around 4 percent — charged by most cryptocurrency exchanges as being problematic. Regular APR:.

Comments

Post a Comment