Personal Finance. Bitcoin’s treatment as an asset makes the tax implication clear. The IRS has made it mandatory to report bitcoin transactions of all kinds, no matter how small in value. The offers that appear in this table are from partnerships from which Investopedia receives compensation. On July 26, , the federal body said it will send educational letters to 10, taxpayers it suspects «potentially failed to report income and pay the resulting tax from virtual currency transactions or did not report their transactions properly. If cryptocoins are received from a hard fork exercise, or through other activities like airdrop , it is treated as ordinary income. Around the world, tax authorities have tried to bring forth regulations on bitcoins.

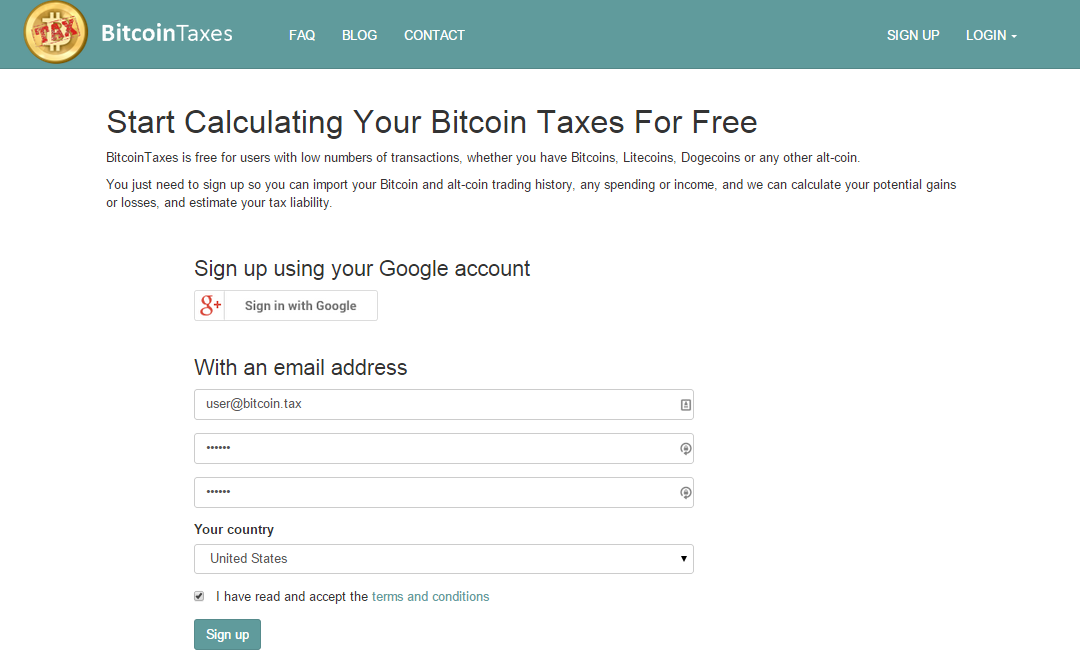

Easily File Your Bitcoin and Crypto Taxes

Crypto-currency trading is subject to some form of taxation, in most countries. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. Remember: Specific tax regulations vary per country ; this atx is simply meant to illustrate if some form of crypto-currency taxation exists. GOV for United States taxation information. A compilation of information on crypto tax regulations in bktcoin United States, Canada, The United Kingdom, Germany, and Australia, which can be found. This bitcoin tax free account can be found. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found .

So I think after the original Capital Gains Tax, there should be no taxation, otherwise, it will be like taxing the same money twice. In Germany, Bitcoin and other cryptos are not considered as a commodity, a stock, or any kind of currency. And because of these rules, I think it is a tax-free heaven for mid-term and long-term hodlers. For more details see here and here. Singapore has historically been a friendly country in terms of capital regulations.

If you own or have traded cryptocurrencies, you may need to include these in your tax forms, even if you didn’t make any money. Tax is the most established crypto tax calculation service that can work out your capital gains and lossess and produce the data and forms you need to file your taxes. Simply upload or add the transaction from the exchanges and wallets you have used, along with any crypto you might already own, and we’ll calculate your capital gains.

Donating cryptocurrencies can really make a global impact! Your donations help those in need, and can also provide tax benefits.

We are excited to be partnered with BitGive, the first and leading Bitcoin and Blockchain non-profit organization, leveraging cutting-edge financial technologies to connect charitable donations to high-impact initiatives worldwide. When you donate Bitcoin to BitGive, it stays as Bitcoin until it’s used. Watch bitcoin tax free account gain value — all tax free — so it can do even more good over time.

Charitable donations can often be claimed as itemized deductions for the given. Add them as Spending in Bitcoin. Tax and it could reduce your tax liability.

Make a Donation with BitGive. Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we’ll work your tax position for you.

We’ll show your Capital Gains Report detailing every transaction’s cost basis, sale proceeds and gain. And your Closing Report with your net profit and loss and cost basis going forward.

You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. Listen in on our cryptocurrency taxation podcast series talking with accountants, tax attorneys and companies about issues around Bitcoin and crypto taxation.

There is some great information on filing your taxes and how the new tax laws might affect you. If you have any suggestions, or would like to be be included in our podcast series, please contact us at. BitcoinTaxes have integrated and teamed up with online tax preparations services to help import your crypto activity into your tax forms. This year, get your biggest possible tax refund — without leaving your living room. If you are a tax professional, CPA, or accountant firm, you can use BitcoinTaxes to import and calculate your client capital gains as well as income from mining or crypto-currency payment processors.

Our Tax Professional and Tax Firm packages allow your users to enter transactions on behalf of your clients, perform the calculations and then download the appropriate tax information. You’ll get all our available features, for an unlimited number of transactions, usable for an unlimited number of clients over each full tax year since Bitcoin started.

See the Tax Professionals and Accountants page for more information and to try it. Calculate Cryptocurrency Taxes Easily File Your Bitcoin and Crypto Taxes If you own or have traded cryptocurrencies, you may need to include these in your tax forms, even if you didn’t make any money. Donations Make a Global Impact Donating cryptocurrencies can really make a global impact! How It Works Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we’ll work your tax position for you.

An Income Report with all the calculated mined values. A Donation Report with cost basis information for gifts and tips. Calculate your Taxes If you are looking for a Tax Professional You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. View the Tax Professionals Directory. Mike joins the show and illustrates how experience in these industries lends to his ability to predict what’s to come in the crypto and blockchain spaces.

Mike also discusses the philosophical nature of cryptocurrency and describes how enthusiasts can maintain their views while still obeying the law of the land. Listen and read. Calculate Cryptocurrency Taxes. Online Tax Preparation Services BitcoinTaxes have integrated and teamed up with online tax preparations services to help import your crypto activity into your tax forms.

Limited time offer for TurboTax Discount applies to TurboTax federal products. Terms, conditions, features, availability, pricing, fees, service and support options subject to change without notice. BitcoinTaxes for Tax Professionals and Accountants If you are a tax professional, CPA, or accountant firm, you can use Bitcoin tax free account to import and calculate your client capital gains as well as income from mining or crypto-currency payment processors.

Took about 10min. Problem solved. GameChng You made a worrisome tax season into a manageable affair. Xavier The premium service saved me lots by using alternative tax accounting methods. Thanks for your hard work and excellent product!! Charles I’m totally impressed by your. James Thanks again, your support is pretty impressive!

Join Bitcoin Community

Personal Finance. However, care should be taken that only cryptocoin donations made to eligible charities qualify for such deductions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Federal tax on such income may range from 10 percent to As of the date this article was written, the author owns no cryptocurrencies. The value received from giving up the bitcoins is taxed as personal or business income after deducting any expenses incurred in the process of mining. Score : The capital of Germany, Berlin, boasts a high 4.

Comments

Post a Comment